2. Microsoft Partner Insights - Financials & Business Outlook

June 24, 2021

This is the second chapter of our 10 part blog series, for more chapters please visit Microsoft Partners Insights.

The year of COVID-19 in review

Microsoft Partners, like all businesses globally, were forced to press pause when the pandemic hit in 2020. But that didn’t last long. As countries locked down and everyone started working remotely there was an immediate surge in the need for many of their services.

Here’s a look back on the events as they unfolded, where possible we’ve used the words of the senior leaders at the Microsoft Partners interview respondents.

In this blog, we look at the:

- Microsoft Partners response to the pandemic

- Top 3 revenue findings

- The Bottom Line: What about profits?

- Business outlook for 2021

March 2020 – Uncertainty as the country locks down

The predominant theme from those interviewed was very positive in the face of considerable uncertainty. Most had initially started the year strong but then took advantage of the resources available to prepare them for what might come next.

“2020 Quarter One was great, and then life stopped in March! 65% of our revenue is recurring and the other 35% just fell off a cliff.”

“We really battened down hatches, furloughed everyone we could.”

But that didn’t mean that most weren’t caught off-guard. The national lockdown presented tough challenges to overcome.

“We had enough to keep us going for a few months but then it ran out. Things were a lot slower, and decisions were under a lot more scrutiny.”

“All our training engagements disappeared. A number of our big customers were badly hit, so things were delayed.”

There were silver linings amongst the chaos. A boost of public sector funding fuelled business for some, “30% of our client base is public sector who saw an uplift in budget.” While the rise in global demand for cloud solutions opened up new markets for others.

“We got a deal from central government within 7 days which is unheard of.”

“Some of our customers realised they had no digital transformation plan for how they access and analyse their data. They were effectively forced into programmes of work.”

Summer 2020 -- Opportunities emerge

By the summer of 2020 the opportunities for Microsoft Partners were beginning to become apparent. And there were many.

They reported, "an uplift in transformation projects" and increased “demand, particularly for intranet solutions.” Data analytics, security, AI and public sector projects saw Microsoft Partners having to recruit to keep pace. Clients leant on Managed Service Providers (MSP's) and Software as a Service (SaaS) companies to survive if they had not started their digital transformation journey already.

The feedback regarding this period was upbeat.

“Data analytics feels like a priority for clients. We are very optimistic.”

"There were challenges to start with in the pandemic, we had a lot more movement in our clients. Some accelerated, some just stood still. We have had 20% growth and there has been significant demand. Some big projects have just carried on, and some transformation projects which we have had to move quickly on."

On reflection, though some businesses had to transition to meet the different and evolving requirements of the pandemic, most felt they adapted, overcame the obstacles they faced along the way and ended the year well.

“Now feeling very confident. Strong team, very strong market.”

“We are now reasonably confident as we have the largest professional services order book we’ve ever had”

“It's actually been a good time - 2 years’ worth of digital transformation in 2 months.”

Top 3 revenue findings

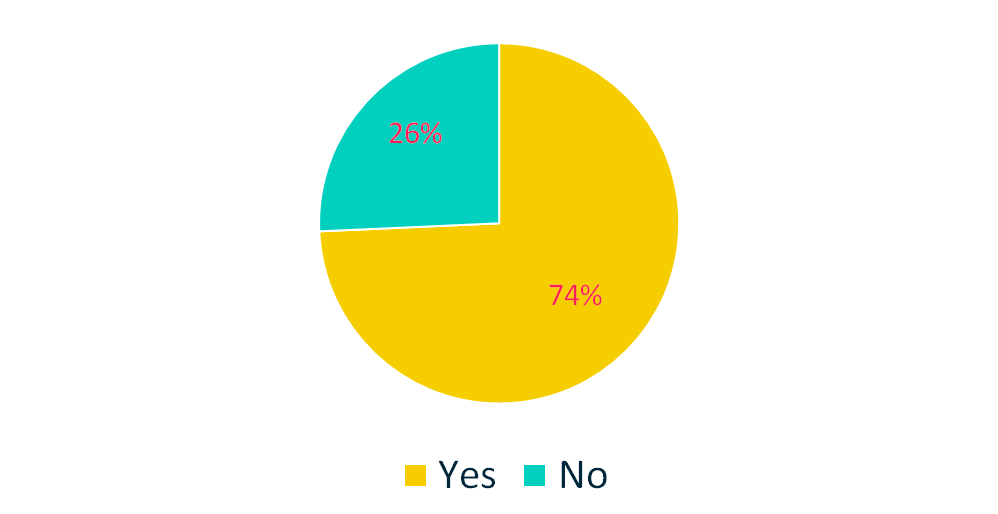

1. Increased revenue for most

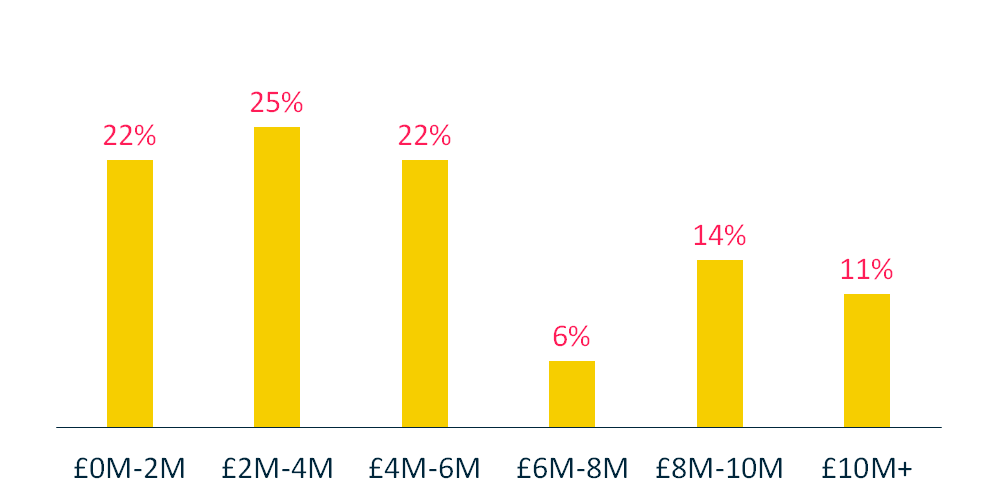

The graph below shows that a quarter of Microsoft Partners generated revenue of between £2m-£4m. This is closely followed by just over a fifth with revenues of £0-2m and another fifth with £4m-6m. In aggregate, almost three quarters of the Microsoft Partners surveyed had revenue lower than £5m.

2. Success impacted significantly by client-base

Which vertical or industry sector the Microsoft Partners serviced also played a crucial role in what kind of 2020 they had. If their customers were established e-commerce, logistics, or some areas of financial services such as digital payment providers, then they did very well. Microsoft Partners that service sectors such high street retail, travel and hospitality and the aviation industry reported a far more challenging and turbulent year.

3. Size matters

The size of Microsoft Partners customers also played a key role in their success. The research highlighted a marked difference between Enterprise customers (2500+ staff), corporate (500-2499 staff), and SMB (<500 staff) in how they responded to the impact of pandemic on their digital transformation journey. It was generally business as usual for Enterprise clients as they had deeper pockets and were more easily able to find budget to support increased IT spend, however for some SMB clients their very existence was called in to question and therefore many sought to cut IT spend.

Top line

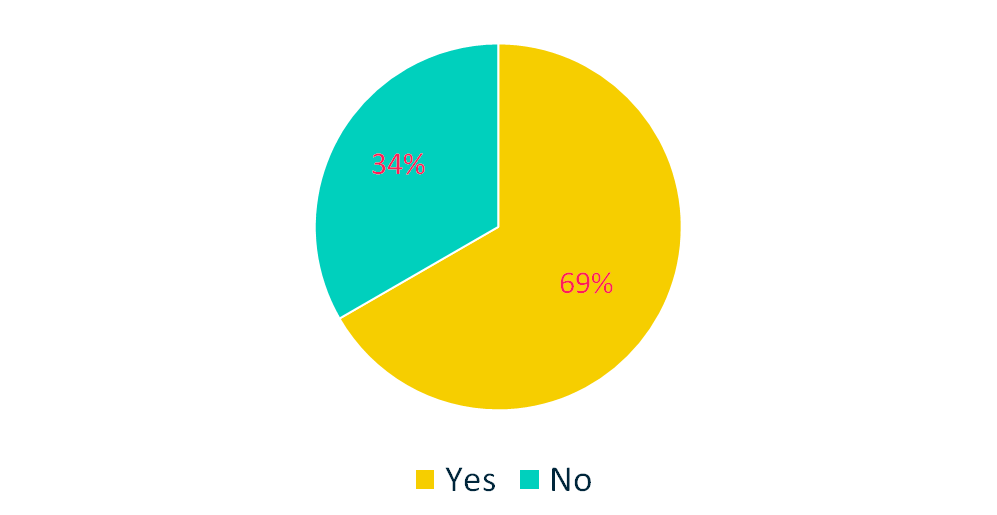

Did revenue increase in 2020?

2020 Revenue

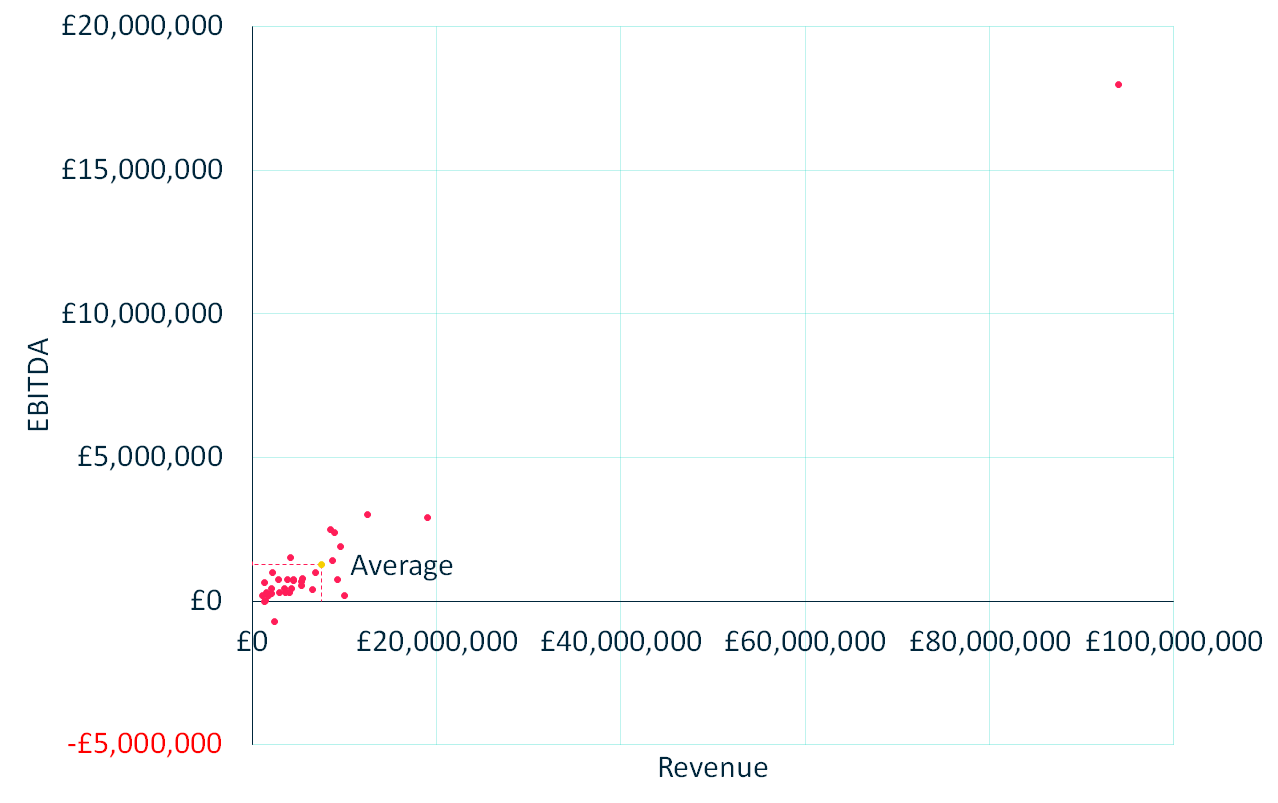

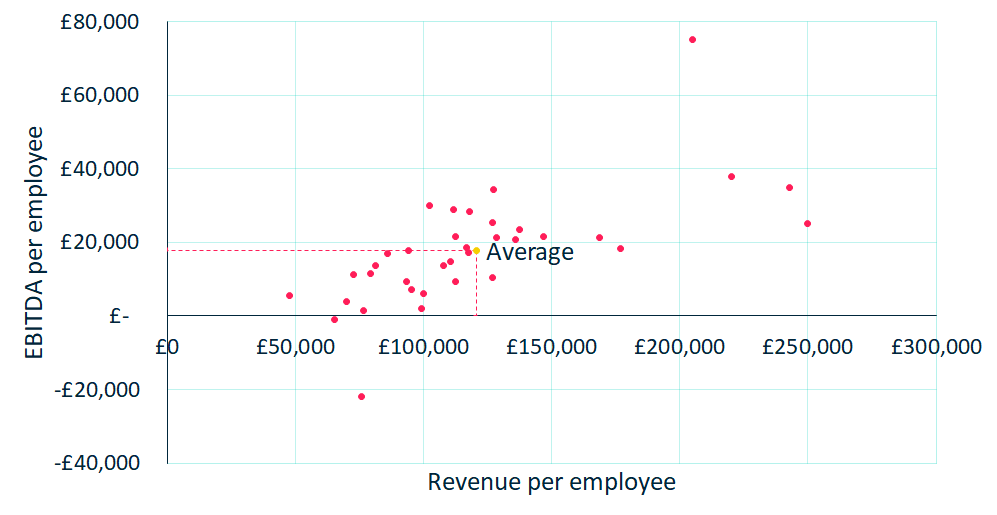

2020 Revenue v EBITDA - All Participants

As can be seen below, there is a diverse spread of Microsoft Partners with one outlier in the top right.

The average revenue reported for the group was £7.5m, with an average EBITDA (Earnings Before Interest Tax Depreciation & Amortisation) of £1.3m.

If we zoom in on the main cluster of companies we get a clearer picture on the EBITDA versus revenue dispersion.

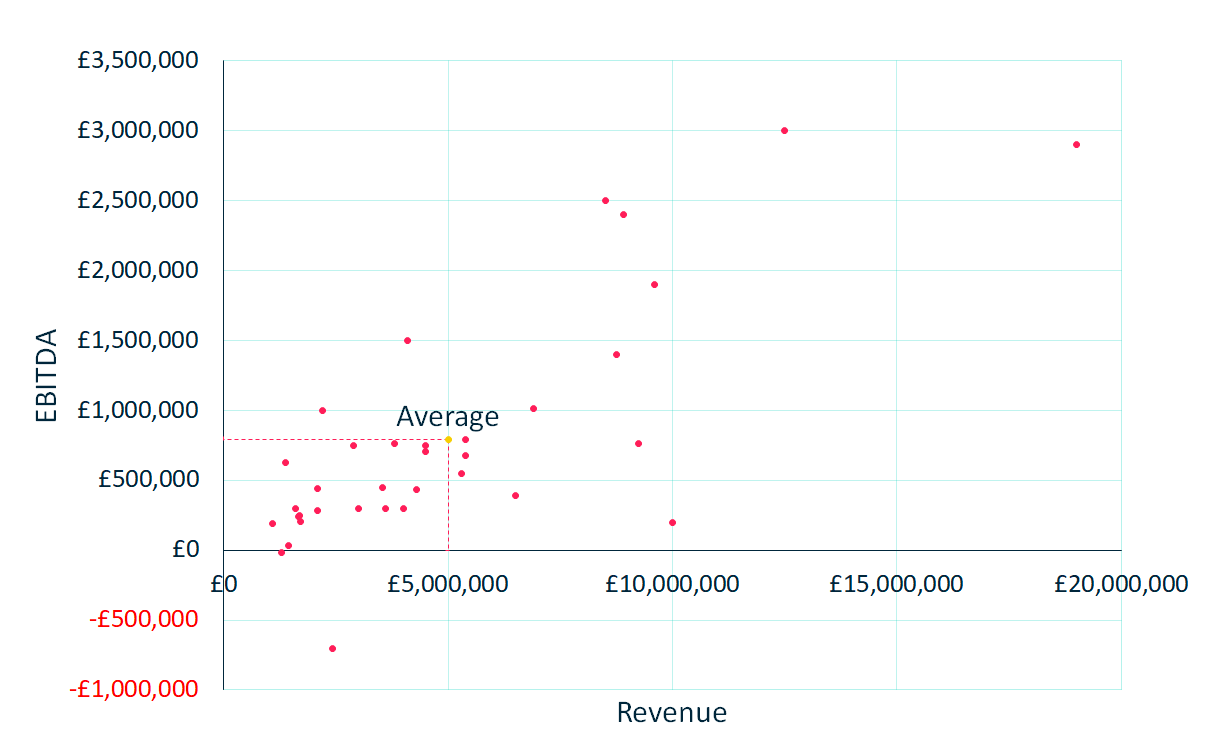

2020 Revenue v EBITDA - Magnified

The average revenue reported for this subset (excluding the outlier) was £5m, with an average EBITDA of £0.78m.

Recurring revenue

This was the life blood for a significant number of Microsoft Partners over the last year. Recurring revenue from annuity products and services stabilised many and enabled them to weather the storm, with a few providers viewing managed services or SaaS products as somewhat ‘pandemic-proof’. Many respondents confirmed this will continue to be a major area of focus in 2021.

Revenue & EBITDA Per Employee

As can been seen from the chart above, the average revenue per employee of the Microsoft partners we spoke to was just over £120,000, with average EBITDA per employee at just over £17,500. This is very positive as a good benchmark for revenue per employee is more than £100k, with the large management consultancies reporting closer to £200k revenue per employee.

Bottom line: What about profit?

Arguably the most important question and metric to any business owner or manager is how the pandemic affected profits. So, we asked them.

Did EBITDA increase in 2020?

Just over two thirds reported an increase in EBITDA (Earnings Before Interest Tax Depreciation & Amortisation) when compared to 2019 results.

Many Microsoft partners reacted swiftly and reduced costs where they could. Costs such as travel and entertainment were naturally curtailed via the national lockdown mandate. Even staff expenses were limited: organising wine tasting or a quiz night via Teams is far less expensive than a hefty bar tab plus travel and hotel costs normally associated with staff events.

Microsoft partners did report increased expenditure to allow staff to work from home more comfortably e.g. equipping employees with good chairs and monitors, although no one felt that this broke the bank.

A positive outcome is that lower costs could be here to stay, Microsoft Partners have proved that clients do not need to have consultants or project teams on site to complete work. Additionally many staff will want to continue to work from home which could result in reduced office costs.

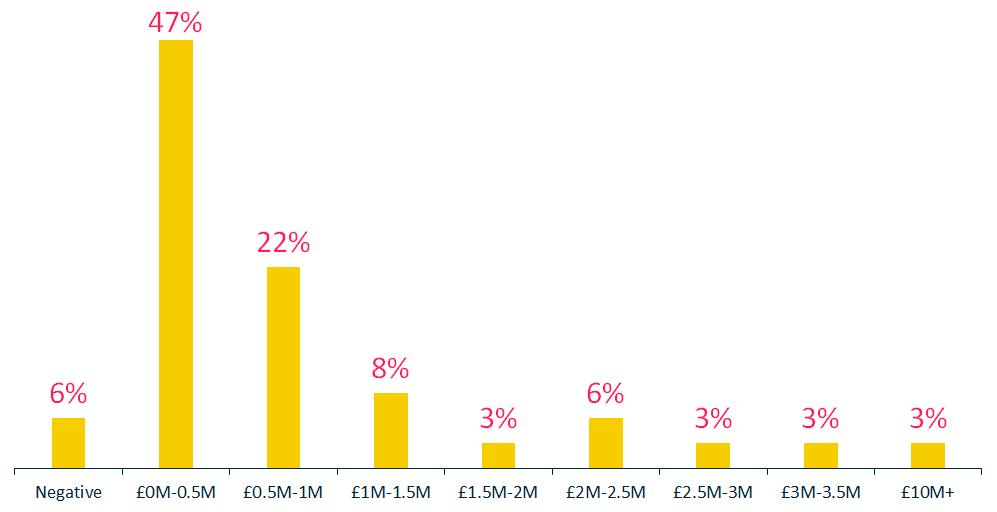

2020 EBITDA

Almost half (47%) of Microsoft Partners surveyed reported an EBITDA of £0-0.5m, with almost a further quarter (22%) at £0.5m-1m and 8% generating £1m-1.5m. This is due to the fact that many of the partners are of a similar size and operating efficiency. The 15% of partners surveyed that make more then £2m of EBITDA tended to be the larger Microsoft Partners. The margins bar chart below shows that the majority of partners make similar margins.

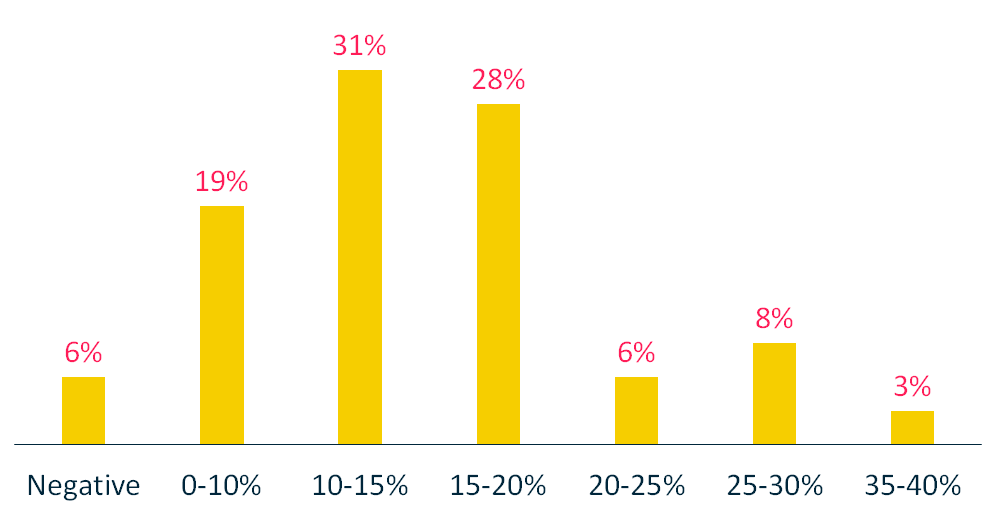

2020 EBITDA Margin

Almost one third of the firms surveyed were operating on a EBITDA margin of 10-15%, followed next by 28% of respondents with a margin of 15-20%. Overall, 94% of companies surveyed were profitable in 2020.

With the majority of Microsoft Partners making fairly similar margins, we dug deeper to find out what the partners were doing to generate higher profits.

First, those partners that were either pure MSP (Managed Services/Support) or Hybrid SI/MSP (Systems Integrator / Project services e.g. consulting with managed services) tended to have more stable income and hence more stable profits. The best performing partners reported gross margins for managed services above 65%.

Second, many of the Partners driving higher EBITDA margins were those that had developed some of their own software. Reported gross margins were 70% to 75% where partners were selling their own in-house IP (Intellectual Property). Very few partners did this exclusively, most sold their software along with consulting services combined with a support service, however the higher margin from the in house IP really made a difference to the bottom line.

Separating the most profitable SI's (System Integrators) that mainly sold project or consulting services was the gross margin made on this. The top performing partners operated at 50% to 55% gross margin mainly due to operational efficiencies. It didn’t matter if the salaries paid to the consulting staff where necessarily higher than average as long as they billed at the right rate consistently (Note: You can read more on salaries in the Microsoft Partner compensation blog soon).

What was also notable was that many of the Microsoft Partners generating the highest profit had developed customer up-sell/cross sell strategies to ensure that they sold as much as they could to every customer they had. This was also combined with customer satisfaction measurement, whereby partners measured their customer satisfaction with various tools to ensure that they were not losing customers due to poor service.

Finally, the most profitable Microsoft partners were also ensuring that they claimed as many rebates and incentives from Microsoft and other vendors, such as CPoR (Claiming Partner of Record), PAL (Partner Admin Link), as well as CSP (Cloud Solution Provider) licence fees. Many also received other funding from Microsoft to help deliver projects such as ECIF (End Customer Investment Funding).

Business Outlook for Microsoft Partners: Looking ahead to 2021 and beyond

After a turbulent year that saw many Microsoft partners and their clients struggle, but overcome, the challenges that the global pandemic presented, there was still cautious optimism from leaders when asked for their thoughts on the business landscape in 2021 and beyond.

Many of the Microsoft Partners entered 2021 with a larger client base and increased order books due to the demand for their services in 2020. The expectation from most is that this demand amongst clients, in areas such as digital and cloud transformation, will continue to grow.

“I think that strong demand for cloud transformation and managed services will continue for the next 3 years at least.”

“Very confident, market buoyant for digital transformation services in our chosen sectors. We grew by 48% last year.”

Pricing was a real issue for some, with several leaders reporting that price compression for the their services had started and had the potential to continue.

“We are already starting to see MSPs having to drop prices, we had to drop by 30% in one instance. It’s a race to the bottom.”

A recurring theme was the uncertainty surrounding the medium to long term impact of Brexit, and was a concern for many of the leaders interviewed. Specifically the idea that the global pandemic had potentially masked some of the fallout of Brexit, not just for themselves but also for their clients. In fact for many of the leaders the biggest concern was for their clients and the impact the pandemic has had on them.

“Customer solvency and survival is a concern. We saw real challenge to some of our clients. Saw some attrition in them and lockdown 3 has been the final straw for some.”

“I am still concerned with COVID and the impact on our customers. None of ours went out of business fortunately but it's a concern…. I'm still conscious that we aren't out of it yet. Will this repeat - will COVID crop up every winter?”

Following a year of recurring lockdowns, global business disruption, and curtailed expenditure it is clear that as we emerge from the other side of the pandemic there will likely be significant pent-up up corporate and retail spending that could be unleashed in the second half of 2021 and beyond, with the I.T. sector uniquely placed to be one of the main beneficiaries of this. The pandemic has really focused people’s minds on how essential I.T. is to our day-to-day lives.

“Information Technology has shown itself to be an important strategic element in organisations need to combat their COVID response. We are still seeing the need for organisations to modernise and move to Office 365 to accelerate that modernisation and change to an “as a service” model.”

“One of the things the pandemic has done, has organised people's view on digital transformation needs. They've accelerated digital/cloud transformations. More momentum has been generated; clients are looking for better alternative ways.”

This is the second chapter of our 10 part blog series, Microsoft Partners Insights.

Do you have a legal question for us?

Whether you are just getting started, need a template package or just some legal advice for your business, we are here to help with any questions you may have.

Our mission is to help you succeed, with less risk.