June 24, 2021

We continue the Microsoft Partner Insights blog series with a look in to the sales and marketing operations of the key UK Microsoft Partners we spoke to as part of the research.

In this blog we also cover:

- The top ways Microsoft Partners win business

- Costs

- Sales & marketing staff salaries

- What metrics are used to determine variable compensation

March 2020 - Trouble ahead for sales?

The COVID-19 pandemic had an almost immediate impact for sales teams globally. New business conversations with clients came to an abrupt halt in March 2020, and most companies faced the prospect of a previously healthy sales pipeline vanishing overnight.

The impact of this event affected how Microsoft Partners acquired and engaged with new clients, forcing many to rethink their sales and marketing strategies. With no ability to arrange physical meetings, roadshows or attend conferences, how you deployed your sales teams also required re-evaluation.

“It has been hard to stay in touch let alone win new business without being in touch.”

“What is difficult is breaking into new clients. I expect new customer sales to be challenging until COVID-19 restrictions are lifted. But hopeful of a bounce back in customer enthusiasm once we are allowed out again.”

“We changed our marketing strategy. Being unable to attend costly events has forced us to rethink our marketing plans."

"We have redirected our marketing efforts to more digital."

Referrals = The top channel for new business

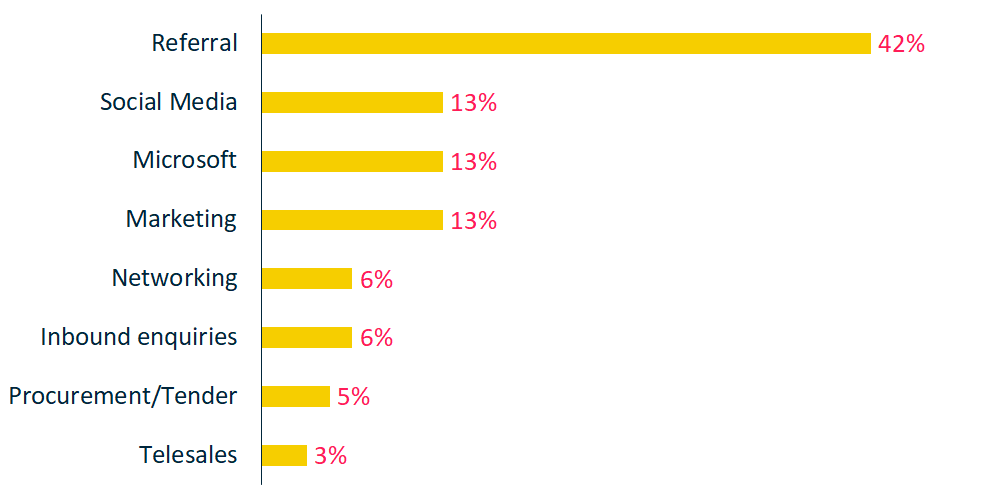

Looking deeper in to how these companies generate sales, we asked CEO’s what were their top ways to win new business.

Top ways of winning new business

With 42% of new business coming from referrals, or up to 55% if Microsoft referrals are also included, it highlights just how important reputation and connections are to winning business.

It may also make some Microsoft Partners question the value or the amount of money they spend on marketing activities, when potentially all they need to do is ask for more referrals from their current clients, or current partners.

However, as marketing can be a bit of an enigma to many Microsoft Partners, they will agree with John Wanamaker, who is credited with coining the phrase “Half the money I spend on advertising is wasted; the trouble is I don't know which half”.

Creative solutions for maintaining relationships

Finding ways to connect with potential clients who were also stuck working from home became the puzzle everyone was trying to solve. Creating regular new content and exploring new and untapped marketing channels yielded positive results for the majority of the group. Many of the Partners we spoke to emphasised the benefits of running webinars in particular, and how they had become an important tool in lead generation.

“With clients, we pivoted to doing more content on YouTube and blogs. At this point, nine months later it has turned into our no.1 lead generation source. That has really paid dividends.”

“Webinars have become more important as a way of nurturing new contacts and generating leads.”

“We have put a lot of effort into web-based marketing. It is harder to run workshops virtually, but we have really tried using things like Microsoft whiteboard, We are trying to engage people rather than push information to them.”

“We are getting more content in front of them, and we ran a number of webinars. Part of our strategy was around partner enablement, to help them out during the crisis.”

Over the last few years Microsoft Partners have increasingly been adapting their sales and marketing strategy, in addition to product/service offering, to align themselves closer to specific client sectors. Spurred on by Microsoft’s championing of vertical specialisation for Partners, these companies have seen the benefit of carving out a niche. This has enabled Microsoft the refer business to Partners more easily, and ultimately increased the probability of winning deals.

“Tailoring marketing to target customers in new way of working, packaging support offerings to target changing customer needs and make them easier to sell, making sure on-point with Microsoft evolving M365.”

Partners have also adjusted pricing models to adapt to shifting client expectations. Many now pricing projects on a ‘per outcome’ basis rather than the historical model of ‘per day’. This has mirrored Microsoft’s own change to a ‘per user/per month’ pricing structure.

Investment for growth

Sales and marketing departments on average accounted for 13.8% of total company headcount within our cohort, with the average number of sales & marketing staff being 6 people (after removing the largest outlier).

Many CEO’s reported to us that investment in sales and marketing teams had been a significant focus towards the end of last year and expected this to continue throughout 2021.

“Sales growth/target attainment has been hard under COVID. We are compensating by investing significantly.”

“We massively stepped-up marketing and hired more senior people, it's a chance to clean up our 'garden', putting in a brand-new website, rebranding. Everyone in the business is writing playbooks.”

“I have been investing heavily, I have recruited 15 people in the last year - senior people. This quarter is forecast to be the best ever, I have so many people in marketing.”

“I’m feeling confident due to the growth achieved in 2020 and the new sales/marketing team that are in place. We've done well, getting a marketing strategy in place. 2021 has started really strong."

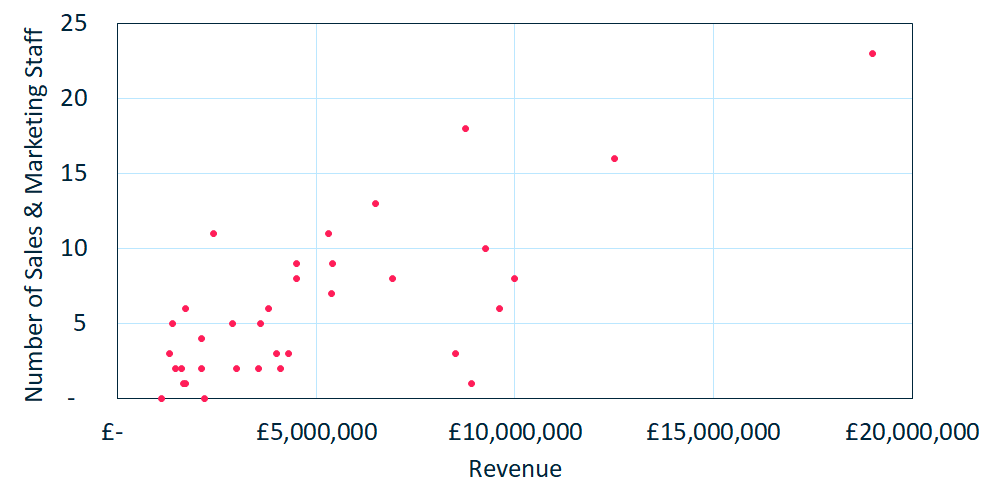

The chart (below) shows 2020 revenue generated and number of sales and marketing staff for the main group of Microsoft Partners we spoke to (Note: one outlying company omitted due to scale).

Sales & Marketing Staff vs Revenue

Although interesting to visualise it is too simplistic to draw conclusions tying quantity of staff to revenue generated, as there are a multitude of variables that are not taken into account here.

Not only were several of the group making more hires in sales and marketing, many were also increasing overall spend in this area.

“We decided to really ramp up our sales and marketing effort rather than scale it down. This is starting to pay dividends.”

“We upped our marketing spend so we were well placed. What we are seeing is that paying off with customers signing up.”

Costs

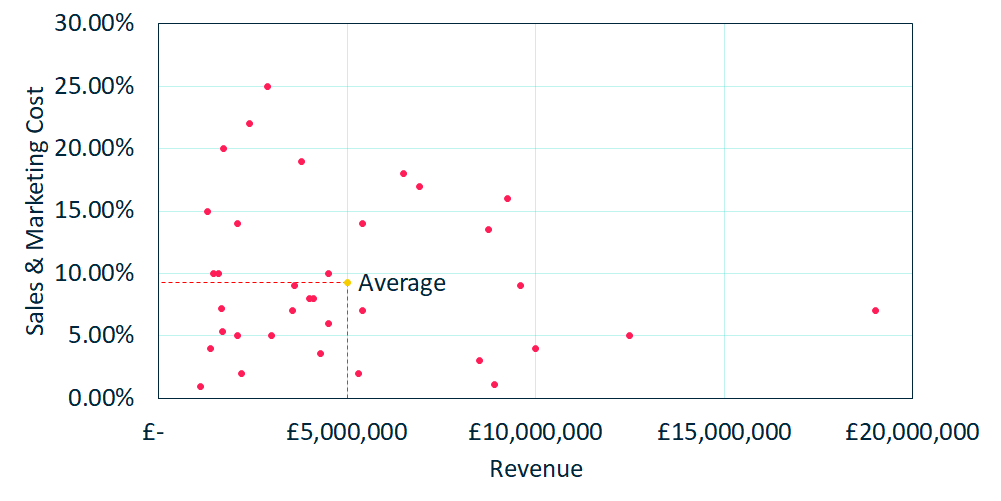

For companies that participated in the survey, our data shows that that on average sales and marketing costs accounted for 9.3% of total revenue. This is not high and 15% to 20% spend is often found in other industries. The partners who were growing faster were often the ones spending more on sales and marketing as a percentage of revenue.

Sales & Marketing % Costs vs Revenue

Note: Outlier removed from the above chart for scale purposes.

Note: Outlier removed from the above chart for scale purposes.

Salary increases delayed to control costs

Aggressively trying to control costs during such a turbulent year was a key initiative many sought to pursue in 2020. This often included delayed or even curtailed pay increases for many companies. The recruitment market however remained buoyant for the most sought after roles.

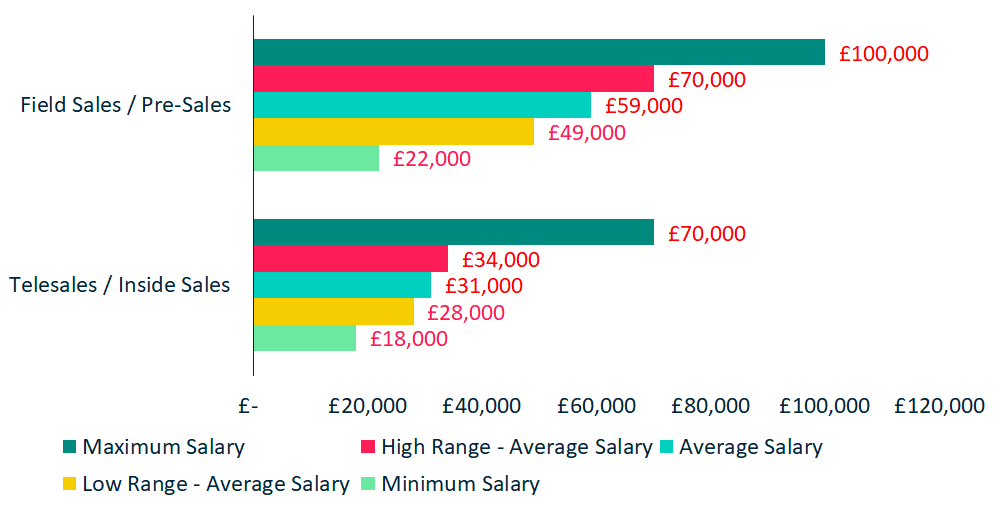

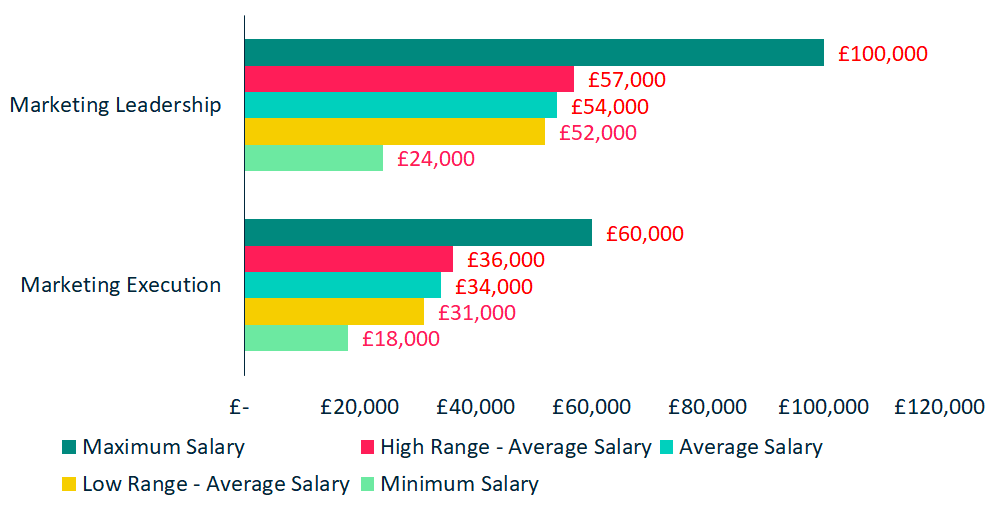

We asked the cohort to provide salary information for various sales and marketing roles, specifically a high and low salary for each function. This enabled us to generate average high/low salary ranges for comparison.

When comparing average salaries, employees in field sales (£59,000) and marketing leadership (£54,000) were almost in-line with each other. Where they diverged was at the higher end of the salary scale, where the average in the high range for field sales staff (£70,000) was 23% more than for marketing leadership (£57,000).

Salaries - Sales

As can be seen from the chart above the salary range for field or pre-sales ranges from £22,000 all the way to £100,000 and telesales/inside sales ranges from £18,000 to £70,000. The disparity is largely determined by experience and the target that the individual carries. For example, a lower paid person is likely to have less experience and will also have a lower sales target. Whereas the more senior staff not only command higher salaries, but they also have more responsibility with a bigger target to hit.

Salaries - Marketing

The average marketing salary bands are quite closely clustered with with a relatively tight spreads between average high and average low salaries. For example, marketing leadership remuneration ranges from £52,000 at the low average to £57,000 at the high average. Only a small number of the larger Microsoft Partners were paying much higher salaries due to the larger teams that the individuals were managing.

This is also true for the marketing execution roles with average ranges only diverging from £31,000 to £36,000, indicating that that most Microsoft Partners are closely aligned on their compensation for marketing roles.

Variable Compensation – Key factors

Driving sales growth, meeting revenue targets and ultimately finding the right incentivisation mix between fixed salary and variable pay/commission for employees to meet these goals, is a constantly involving topic.

When discussing this with the group, those that have dedicated sales staff, 83% of them said they pay a variable component within their total compensation structure.

Within this subset of companies the average guaranteed/variable income ratio was 70% guaranteed and 30% variable, with just under one third of the group using a 50%/50% ratio.

Creating an incentivisation structure that mutually benefits the employee and the employer is key to longevity and sustainability. We were interested to find out more about how the Partners quantify and measure the variable pay component and what exactly is it based on?

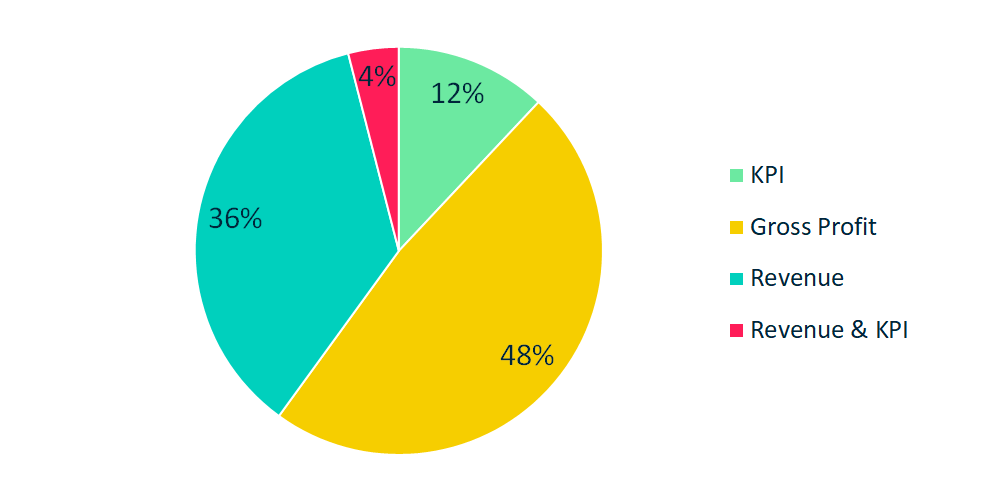

What is the variable or commission pay based on?

Almost a half of the group pay commission based on gross profit rather than revenue, therefore incentivising sales staff to focus on maintaining margins and not offering discounts purely to win deals.

It was also interesting to note that 16% of companies had pay linked to Key Performance Indicators (KPI). This is a growing trend amongst employers to reward sales members for demonstrating the appropriate behaviours; whether that be selling more of one type of product than another, adding value by cross-selling with other parts of the business, or even tying compensation to customer lifetime value for the firm.

“We've really had to focus on looking after our clients. With sales strategy, we've targeted and got account managers to be really focused around KPIs.”

This is chapter 7 of our 10 part blog series, to read the previous chapters see: Microsoft Partners Insights.

Do you have a legal question for us?

Whether you are just getting started, need a template package or just some legal advice for your business, we are here to help with any questions you may have.

Our mission is to help you succeed, with less risk.